What are the differences between a regular board of directors and an advisory board?

An advisory board is more informal than a board of directors in that it generally does not have regular meetings, has little or no delegated authority and is created primarily to provide business advice and bring specialist skills or knowledge to the owner and business.

What is the legal position of directors on advisory boards?

An advisory board is not legally constituted and has no decision-making power (unless specifically delegated). Further, the owner is under no obligation to heed its advice.

What are the pros and cons of an advisory board?

An advisory board is a good choice where the owner or company needs ongoing professional advice and contacts, but may feel threatened by a formal board with the power to direct the business or where the ‘legal’ board is made up of managers as is sometimes the case with subsidiary companies. However, an advisory board’s effectiveness will depend on whether the owner or management respects its advice and/or takes advantage of the knowledge and skills it brings.

When might a company consider setting up an advisory board?

An advisory board is a good choice where the owner or company needs ongoing professional advice and contacts. An advisory board with the requisite professional skills will serve as a sounding board, a source of ideas and expertise. In the case of succession planning, an advisory board can be particularly useful in helping an owner get an objective view on the potential successors and what they might require in terms of skills building and to help facilitate transition in ownership and/or management.

What steps can you take to ensure that the board will be effective?

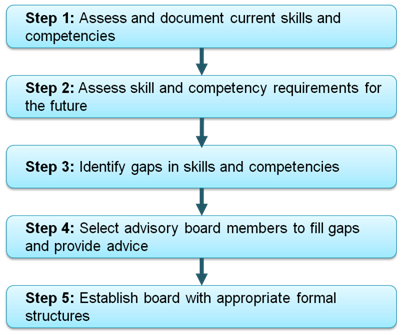

Optimal use of an advisory, or formal, board to leverage the management team will be enhanced, if the following steps are taken:

Step 1: The first step in the process involves assessing and documenting the skills and competencies available to the owner on the management team. It is important to know and have a clear understanding of what people in the organisation know and can deliver.

Step 2: It is then necessary to understand the environment in which the business is operating and what skills and competencies are required for the business to remain sustainable and its potential for growth should the owner wish to sell.

This is also the stage during which clear job descriptions for key management positions, including any special skill requirements and personal qualities, should be developed for the initial board tenure and up to five years in the future.

Step 3: When the owner has an understanding of the business’s current and future human capital requirements they can assess where the gaps are and define their specific needs in establishing an advisory board, i.e. the role the board is to fulfil.

Step 4: Once the owner has decided where the gaps in their own and management’s skill sets lay, they can bring in ’advisors’ to fill gaps. An advisory board is in essence ‘a management think tank’, so the skills, knowledge, experience and networks of its members should complement and supplement those present in the business.

The variety of skills, knowledge and experience the board may require to effectively fulfil its roles include:

- Technical skills/abilities, e.g.

- Accounting/financial skills

- Legal skills

- Relevant industry experience

- Marketing experience

- Experience in developing and implementing strategy

- CEO level experience

- Advisor capabilities, e.g.:

- Strong communication skills

- Interpersonal and relationship management skills

- Time availability

- Personal attributes

- Honesty, integrity and high ethical standards

- No conflict of interest

- Strong analytical and lateral thinking skills

- Ability to coach and mentor managing director and senior management

- Network of contacts

Step 5: The final step involves putting in place the formal structures such as charters, policies, processes and procedures that facilitate the board’s operations, ensuring the optimal use of the advisors’ time/costs. For example:

- Board charter

- Board agenda

- Board papers

- Board minutes

What mistakes does a company need to avoid?

The selection and appointment of directors is one area where mistakes are often made in establishing advisory boards. A company should focus on the necessary and desirable competencies of board members. Similarly, there should be a process for regularly reviewing the advisory board’s capability requirements against the mix of composition. This will ensure that the board can develop and evolve in line with business requirements.

Do advisory boards have an impact on corporate governance – do they impose greater discipline, for example?

Demonstrating good governance practices will improve a company’s access to capital as it provides confidence to investors, financial institutions and venture capitalists that the company has instituted better systems of internal control. This is particularly the case for companies seeking growth and expansion such as those in the technology sector. Therefore, implementing good governance practices and procedures at the earliest opportunity is advisable. Third, a well-structured advisory board, or formal board, can contribute to the performance of the business through roles such as strategy, advising and mentoring the owner or CEO and providing the business with vital contacts or resources.

Are there any risks to directors on an advisory board?

An advisory board has none of the formal legal responsibilities for the overall performance and well-being of the company. This task rests with the ‘legal board’ directors, as required under the Corporations Act. However, careful consideration needs to be given on the structure of this advisory board to ensure the participants are not deemed as “shadow” directors.